How Zidisha, A Microlending Org, Is Changing Lives

Folks, I support Zidisha, an org that was one of the finalists in the Women Startup Challenge. They're the real deal. Julia Kurnia, Founder of Zidisha wrote a guest blog post describing the good work that they do.

Kurnia said:

Those of us who grew up in wealthy countries tend to allocate the rest of the world to an unreachable place. We read about developing countries in charity literature and in National Geographic, but most of us have never traveled to one. We try to help people in the world’s poorest places, then are turned off by the inefficiency of the gatekeepers that collect our contributions.

The thing is, our world view is long outdated. The internet is overcoming geography for a rapidly growing percentage of the world’s population. Young adults in places like Ghana and Indonesia may live on a couple dollars a day, but they use Facebook and Twitter as comfortably as their counterparts in Norway and Japan. In many developing countries we can send electronic payments cheaply and instantly to anyone with a $5 cell phone. These technologies are eroding the old gatekeeper organizations’ monopoly on philanthropy.

The thing is, our world view is long outdated. The internet is overcoming geography for a rapidly growing percentage of the world’s population. Young adults in places like Ghana and Indonesia may live on a couple dollars a day, but they use Facebook and Twitter as comfortably as their counterparts in Norway and Japan. In many developing countries we can send electronic payments cheaply and instantly to anyone with a $5 cell phone. These technologies are eroding the old gatekeeper organizations’ monopoly on philanthropy.

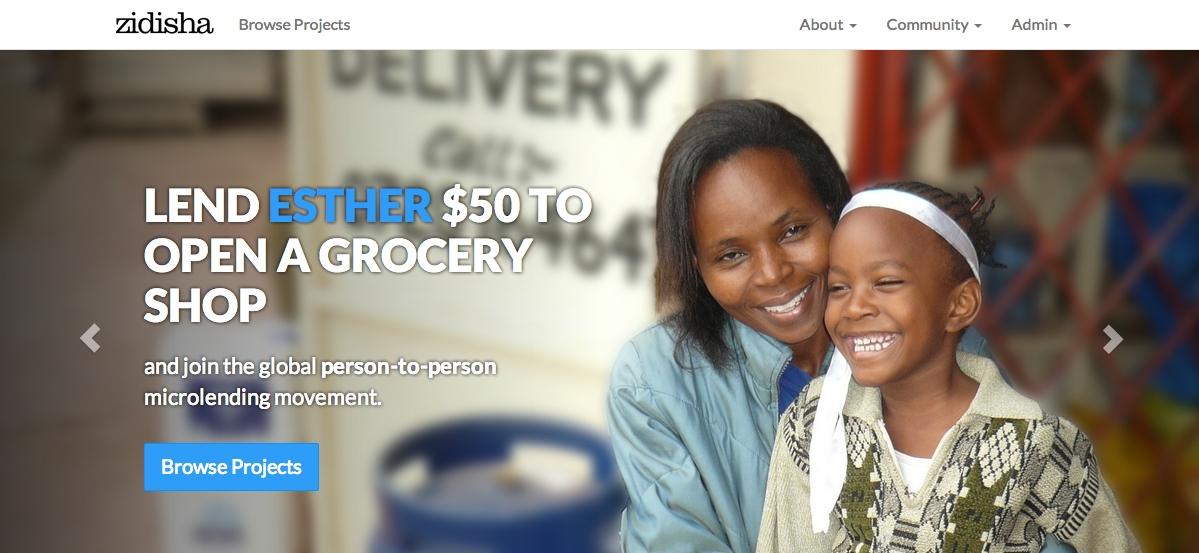

The online microlending platform I founded, Zidisha, is a case in point. The purpose of microlending is to facilitate life-improving investments, especially small business development, for low-income households. But for decades, microlending in developing countries has been controlled by local banks which charge exorbitant interest rates - usually in the 40% range, sometimes much higher - to borrowers with few other options. Even loans funded at zero interest through charitable organizations are passed on to local gatekeepers, which charge an average of 35% interest to the end borrowers. Such high interest rates eat into borrowers’ profits, making it hard to get ahead by taking out microloans.

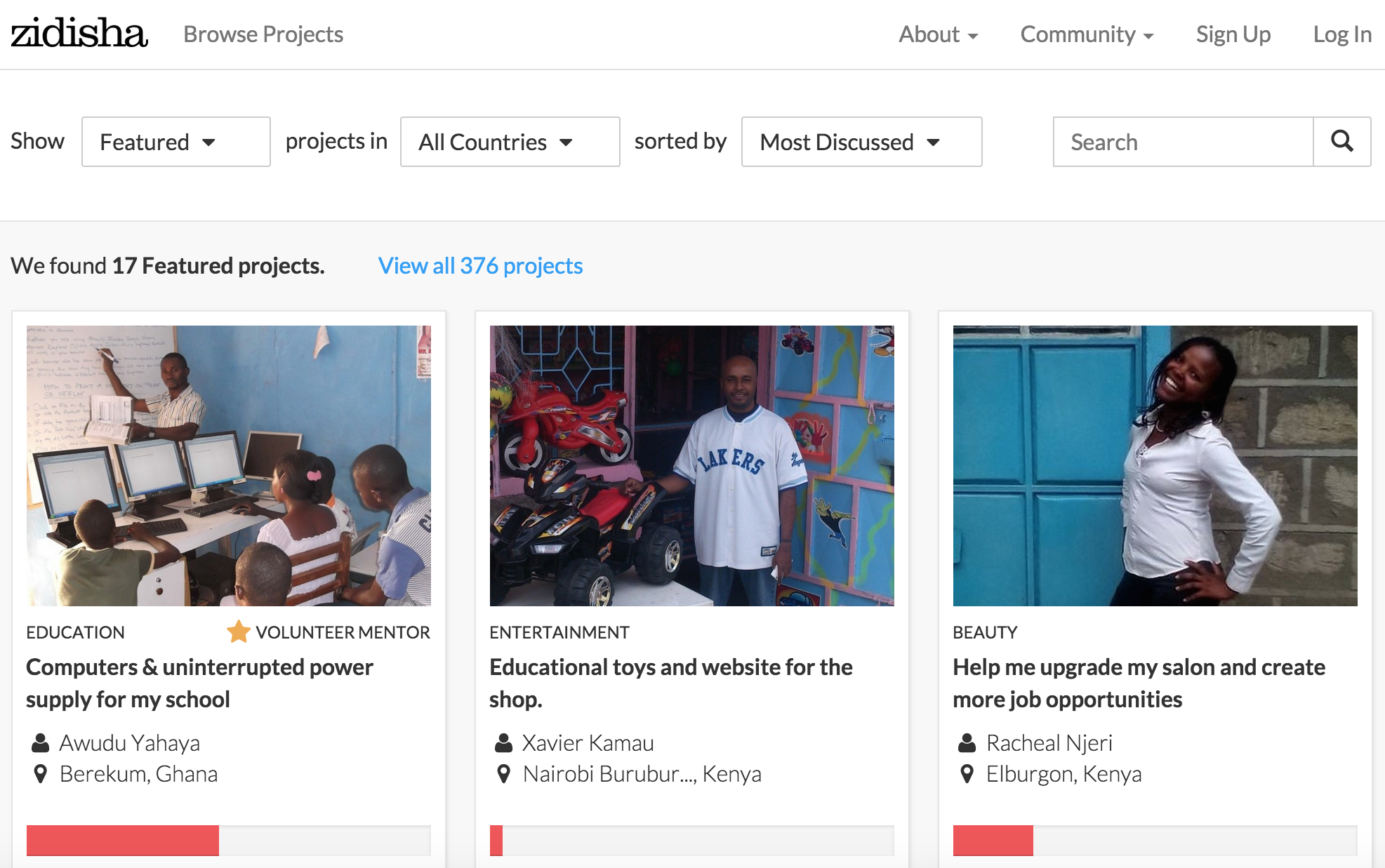

Zidisha is the first microlending service to eliminate local banks and connect individual lenders and borrowers directly. Instead of expensive brick-and-mortar offices and loan collection agents, we use online communication and eBay-style feedback ratings to vet applicants and incentivize repayment. We don’t hire anyone to write up borrower stories. Lenders and borrowers simply exchange questions, news and photos directly via Facebook-style profile pages.

Instead of the 40% interest rates that are typical in microlending, Zidisha borrowers make a one-time deposit into a reserve fund (used to refund lenders in the event of default) when they first join, and thereafter pay only a 5% money transfer fee for each loan. Instead of ceding their business profits to local banks, they can invest them in their children’s education and further revenue-generating assets.

A loan of just $200 is life-changing for someone living on a few dollars a day. Bineta in Senegal used to sew dresses by hand, often going unemployed for long stretches while she saved enough money to buy materials for her next dress. In a good week, she produced one or two dresses. Bineta invested her first Zidisha loan in a sewing machine and inventory of fabric, which increased her capacity so much that she hired an employee. Today, she’s producing a dozen dresses per week and is earning enough to put her nephew through university.

Bineta Sarr with her Zidisha-funded sewing machine, Senegal

Today, so many entrepreneurs are joining Zidisha that many worthwhile loan projects are expiring for lack of funding. That’s why I’m asking for your help. Please take a few moments to explore the projects at zidisha.org, and consider supporting one of our entrepreneurs. The connection you make will be life-changing - for both of you.